IRS Rules for 45Q Tax Credit Clear Path for US Carbon Capture Projects

By Dr. Matt Lucas, Managing Director, Business Development

At New Energy Risk, we’re excited about carbon capture technology, which is critical for hard-to-decarbonize industrial infrastructure. For carbon capture to continue to iterate and improve, it needs non-recourse project financing and the traditionally conservative tax equity community to come to the table. Tax equity is critical for monetizing the US federal tax credits like 45Q.

45Q is available for 12 years to incentivize carbon capture technology deployment for utilization, enhanced oil recovery, and geologic sequestration. To help attract tax equity, NER’s technology risk performance insurance solutions are a critical part of the desirable financial infrastructure. NER's solutions are specifically tailored to the needs of carbon capture to address concerns about technology performance, credit recapture, and financial responsibility for geologic storage.

As we’ve talked with project developers, we’ve noted that 45Q has presented almost as many questions as answers, which has lead to project paralysis.

Luckily, as of May 28, the IRS has finally provided responses to many project developers’ longstanding uncertainties surrounding 45Q, so that these projects can proceed with the required certainty to make use of the 45Q tax credit.

In the rest of this article, we’ll summarize the key takeaways of that update and get a bit into the weeds.

45Q Reform and Updates as of Early 2020

45Q was reformed in 2018, increasing its value and removing a limit on the number of credits available, which had created uncertainty and stifled the utilization of the credit. Congress left many details to be determined by the IRS in a rulemaking process, which the IRS opened to the public in Notice 2019-32.

During this rulemaking, the clock was already ticking since the reformed 45Q statute includes a Commence Construction deadline of January 1, 2024. The carbon capture community was stuck in a catch-22: rushing to meet the construction deadline while lacking clarity on how the tax credit would be implemented. Then earlier this year, the IRS issued two guidance documents, Notice 2020-12 and Revenue Procedure (RP) 2020-12, which addressed a few of the many outstanding questions left by Congress on how to implement 45Q.

Notice 2020-12 included:

- Definition of ‘Commence Construction’ to include both ‘Physical Work Test’ and ‘5% Safe Harbor’ pathways, analogous to other renewables tax credits

- Allowance of a safe harbor for a continuous construction period of six years, which compares favorably to the four years for wind and solar

The RP 2020-12 included details about permissible partnership structures, including that the partnership does not need to generate cash revenues. Normally, business transactions may not be completed solely for the purpose of a tax benefit. However, in the case of carbon capture with geologic storage, the only revenue is the 45Q tax credit. Importantly RP 2020-12 explicitly allows for insurance (like New Energy Risk’s solutions) to be used to ultimately mitigate investor risks.

So, What Just Happened?

On May 28, 2020, the IRS issued REG-112339-19, which finally answers all of the major remaining questions:

- Recapture of tax credits in the event of CO2 The recapture period begins with the first injection of CO2 for geologic disposal and ends five years after the last claim of a 45Q credit or when monitoring ends, whichever comes first. Recapture will operate on a last-in/first-out basis beginning in the current tax year. For storage sites supplied by multiple projects, the leakage is allocated on a pro-rata basis. The guidance explicitly allows for recapture insurance (which New Energy Risk could support).

- Credit transfer is a unique aspect of 45Q that allows the capture equipment owner to elect to transfer the credits to other taxpayers within the carbon capture partnership. Credit transfer is complementary to tax equity investors, allowing 45Q credits to be allocated to project partners with tax liability or to be monetized by conventional tax equity investors. The IRS allows for an election each tax year for all or a portion of the tax credits to be assigned to one or several claimants.

- Protocol for carbon accounting for utilization. The IRS requires a lifecycle assessment (LCA) by a licensed, third-party firm consistent with ISO 14044:2006 standards. The LCA must account for all greenhouse gases, which means that carbon utilization projects can use 45Q to monetize savings in both CO2 and other, more potent greenhouse gases.

- Protocol for secure geologic storage. It’s important that CO2 stored underground stay there. Two types of wells can be used to accomplish this. Class VI wells, used only for CO2 storage, already require compliance with an EPA regulation called Subpart RR, and that reporting will be accepted by the IRS. The IRS decision to accept EPA reporting saves work for project operators. The other type of well, called Class II, is used in enhanced oil recovery. Operators may opt into reporting to the EPA under Subpart RR or use a new international standard for CO2 storage, the ISO 27916:19 standard. However, state and tribal reporting will not be accepted.

The rule also helpfully and expansively defines ‘Carbon Capture Equipment’ broadly to include all the equipment used for capture, treatment, and preparation of the carbon oxides, but excludes the transportation and disposal/injection/utilization equipment. The rule also defines a ‘Qualified Facility’ in the context of industrial sites where some equipment is pre-existing. The IRS applied the 80/20 rule, whereby the site qualifies if 80%+ of the capital equipment is new.

As more carbon capture projects start up, aided in part by 45Q and the IRS’s new guidelines, we’re very excited to see the industry advance through proof of performance and scale. To get there, NER can play a key role in supporting project financing. If you’re involved in a carbon capture project and we haven’t spoken yet, please give us a call so we can discuss opportunities to partner.

###

Renewable Natural Gas Can’t Deliver The Carbon Neutral Future We Need

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

In the fight to supplant fossil fuels and build a climate friendly global economy, renewable natural gas (RNG) has been proposed as a prudent and cost-effective method of decarbonizing fossil-based natural gas. As a carbon-negative fuel source that works interchangeably in the hydrocarbon infrastructure we already have, RNG promises a rapid offsetting of the anthropogenic carbon dioxide (CO2) emissions from fossil gas without the need to reconfigure large portions of our energy delivery system. Mix some carbon-negative RNG in with fossil natural gas and voilà: The overall mix is carbon neutral. New research out of Georgia Tech, however, paints a different picture: At any meaningful scale, RNG is likely to be more carbon intensive than flaring is.

The promise of RNG is rooted in the comparatively high global warming impact of methane, the primary ingredient in natural gas. Although CO2 gets all the attention, methane is a significantly more potent greenhouse gas, having a global warming potential approximately 30 times greater than CO2. Methane is generated as a natural byproduct of many modern processes, from landfills to waste-water treatment to dairy farming. In these systems, organic materials are broken down by bacteria, which generate methane that generally escapes to the atmosphere, contributing to global warming. If that waste methane is instead captured and utilized in an engine, water heater, cooking stove, or other device normally fueled by natural gas, the global warming impact of the methane emissions is avoided. As a result, RNG under this scenario is carbon negative.

This math works if the captured methane is truly a waste methane that was otherwise going to be released to the atmosphere. Unfortunately, the amount of waste methane that can be made into useful RNG is a small fraction of the overall need (most estimates cap out at 10%). The authors of the new research argue that any structure that rewards the production of RNG is likely to create an incentive for producers to make more “waste” methane for capture from other sources (e.g. wood or other biomass). Methane purposefully created to be captured and used as RNG isn’t really a waste: If it weren’t for the desire to make RNG, methane from these sources never would have been created, and therefore was never at risk for release to the atmosphere. As a result, any action to scale RNG production will make it increasingly difficult to determine what portion of produced RNG is resultant from methane that was truly a waste product (i.e. that it would not have been otherwise captured and utilized). That means a lot of RNG would simply be, at best, carbon neutral.

"Carbon neutral" still sounds pretty good compared to fossil natural gas, but as the authors point out, the very gas infrastructure RNG hopes to utilize partially undermines that promise. The problem is that our gas infrastructure is leaky, losing between 1% to 3% of gas, and if most of the RNG produced is merely carbon neutral, the release of even a small fraction through these leaks degrades its climate-friendly bonafides since methane has such a high global warming impact. The result is RNG turned upside down: A system designed to prevent the release of waste methane instead becomes a system that leaks manufactured methane.

The utilization of RNG at scale to supplant meaningful quantities of natural gas would still be less carbon-intensive than fossil natural gas, but the authors argue this may not be the best strategy if greenhouse gas reduction is your primary goal. If decarbonization is the sole consideration, waste methane is best utilized in an on-site flare (or other on-site usage); the fossil gas grid is better replaced with electrification, green hydrogen, or other solutions. Compared to this outcome, RNG usage in the gas grid is necessarily more carbon-intensive.

Supporting Black Children’s Emotional Health Amid Racial Injustice

In The Fight For Our Public’s Health, Solidarity Today For An Inclusive Tomorrow

We Need A Reset. Our Future Depends On It.

This doesn’t mean that RNG is of no value in the fight to decarbonize: RNG is demonstrably better than fossil gas, is still carbon negative (even with manufactured RNG mixed in) when compared against uncontrolled methane release, and it has the ability for rapid deployment through existing infrastructure. Despite the arguments of the authors, economic costs and time-to-market have to be considered in addition to decarbonization potential. And currently, the potential of RNG hasn’t approached the available waste methane resource, leaving lots of low-hanging fruit. But the production of RNG at scales that rival our natural gas demand will also be more carbon-intensive than alternative solutions to decarbonize the gas grid, as the authors demonstrate, and incentivizing its use now will lock in its production for decades. Policymakers aiming for a carbon-neutral future should take note: Blanket support for any RNG will miss the benefits and drawbacks when compared with other solutions. The best policies will account for the full life-cycle impact of RNG, like California’s LCFS program, to incentivize the use of RNG derived from true waste methane. Even then, the math says carbon-negative RNG can only supplant a small fraction of our natural gas demand. Anything else is best seen as an important but incremental step to bridge the gap while the slow change away from gas usage takes hold.

###

Corona-Lockdowns Shutter Vital Research

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

The image of invention and research in popular culture centers on the lone genius, toiling away silently in a darkened lab while discovering critical breakthroughs that move society forward. Real life isn’t like the movies: 21st century R&D is highly dependent on multidisciplinary teams working hand in hand at shared research centers spanning multiple geographies to advance critical science.

Unfortunately, the conferences, workshops, and daily interactions that are the lifeblood of modern research have stopped as COVID-19 has shuttered labs and facilities worldwide in the (noble and required) goal of saving lives. As a result, our collective progress on solving critical technical challenges is grinding to a halt.

Strewn about on a wooded hill with commanding views of San Francisco and the Golden Gate, the jumbled campus of the Lawrence Berkeley National Laboratory sits eerily quiet. But for essential staff and a select group of researchers utilizing specialized equipment for time-sensitive COVID-19 studies, the lab is essentially closed. Specialized equipment found nowhere else on Earth sits mostly idle, user-facilities normally open to outside groups and companies for cutting-edge research are shuttered, and conference rooms are deserted. The lab even posted a video showing empty parking lots and frolicking deer with a somber musical overlay.

The story is the same at national, academic, and corporate labs across the globe. As MIT professor Asegun Henry put it in a recent interview for Scientific American, “We’re shut down. There’s no more lab work. We’re holding meetings virtually, but it’s a devastating blow to our research.” Conferences have stopped, too: The February meeting for Biogen in Boston led to 70 new cases of COVID-19, prompting the cancellation of hundreds of conferences worldwide. Major events, including the American Chemical Society National Meeting and Expo, have been put on ice.

These stoppages have major ramifications, including for the fight against climate change. Ongoing research hampered by the current circumstances include studies of new battery materials, more efficient or cost effective solar systems, and direct air capture of carbon dioxide. Outside the lab, the inability of researchers from across the globe to come together and share recent successes (and failures), identify new opportunities, and form collaborations also hinders progress by limiting knowledge exchange. Simply put, the technology breakthroughs we need to fight climate change are being delayed even though time is of the essence.

Despite this unprecedented setback, there is some hope on the horizon. Nature reports that the break in conferences is giving researchers a chance to rethink the format entirely; collaborative events more impactful, more equitable, and more suited to the current times may yet develop. One such example: MIT launched a weekly webinar series to share progress on new ideas and advancements in the fields of thermal energy conversion, storage, transport and utilization (admittedly esoteric, but close to this author’s heart).

On the policy side, Dr. Addison Stark at the Bipartisan Policy Center (BPC), who has extensive experience in academic and government research, has drawn attention to this issue. The BPC has recommended policy solutions to ensure that research can ramp up when facilities reopen and life returns to some semblance of normal. Addison notes that, “Without federal investment, the current disruption to the United States' R&D and innovation sector could slow down U.S. economic growth for decades to come. Increased funding for innovation needs to be part of future stimulus and recovery legislation in order to get our innovation-driven economy back on the rails.”

If policymakers listen to these ideas, there may be a silver lining on the COVID-19 pandemic: additional motivation for the badly needed increase in research dollars to support the groundbreaking technologies of tomorrow. If not, we’ll be putting all our faith in that lone genius, toiling away in a darkened lab.

###

Interview: Karen Chang, Senior Portfolio Asset Manager, Bloom Energy

We are inspired by people who are passionate about technology that solves pressing global challenges. Scaling and commercializing those solutions requires serious knowledge, courage, perseverance, and support systems like those who work in the insurance industry. In this interview series, our chief actuary, Sherry Huang, talks with friends of NER whose work makes a difference, and whose journeys will inspire you, too.

This interview has been lightly edited for clarity.

Karen is the senior portfolio asset manager for our client, Bloom Energy. Her team is responsible for managing a portion of Bloom’s large operating assets and coordinating efforts among multiple departments within the company.

I have been working with her team since I joined NER and have always been extremely impressed by Karen. We often ask detailed questions about the performance of our clients’ assets, and she consistently has well-documented answers for us. We connect at least quarterly for this diligence, and I regularly sense how proud she is of her team’s work, which makes us proud to work with them, too!

Karen, I understand you are a mechanical engineer by training. How did you decide to pursue engineering and how did you find your way to Bloom Energy?

I decided to pursue engineering because I was good at math in high school and thought having a specific skill would lead to more career certainty. My family all had business backgrounds and were initially not very supportive of my decision to pursue engineering in college. I started out studying electrical engineering but switched and graduated with a B.S. from UCLA in mechanical engineering.

My first job was an internship at NASA, through a partnership they had with CalTech at the time. Over time, I realized I did not want to do pure engineering work and ventured out to more operation strategy roles. A process improvement management consulting job brought me to Silicon Valley, and I ended up getting a job at Bloom Energy, which had the perfect dynamic that I was looking for.

Bloom Energy has grown so much and became a public company during your tenure there. How has your role changed during this time?

I’ve gained my experience within the same department since I joined Bloom, so my role hasn’t changed that much. However, the job itself is ever changing, and new projects are always exciting and challenging. I work at the intersection of engineering, process optimization, business operations and finance, so there is always a lot going on.

Despite being a public company, Bloom still has a flat structure compared to some of the places where I worked before. As a result, I can voice my suggestions and concerns easily, and decisions are made quickly around here.

Do you have a mentor who inspired you during your career?

A manager at Realization Technologies showed me what it is like to be a good team leader. Our team spent a lot of time together on the road with our consulting projects, and this manager led the team without being authoritative, and was smart but humble, and very caring and worldly. We all wanted to be on his team regardless of the projects.

I also really enjoy peer monitoring with my teammates here at Bloom; we are always very eager to share any new knowledge we’ve learned with each other and have a great, open working relationship.

Since we work in different fields, I’m curious what is your impression of the insurance industry?

Before working at Bloom and interacting with NER, my only exposure to insurance is the standard home, auto and life insurance. I was surprised to find out about the application of performance insurance and have been impressed with NER’s technical knowledge to understand the nuances of our data. You guys ask some of the most detailed questions!

We’re glad to hear that, Karen!

Any advice for young women pursuing an engineering career?

Avoid having bias against yourself and don’t let other people define your boundaries. Be confident about your choice, whatever that might be, and ignore the statistics of certain fields being male dominated. Do not be afraid to pursue your dream – there are a lot of opportunities out there!

Finally, please tell us about a passion that you are pursuing, or one that you would like to prioritize more.

If I had more time, I would like to get better at investing, which has always been an intriguing topic for me. I’d like to have financial freedom early so working is an option but not a necessity. My husband and I are also into videography and used to run a business doing corporate and wedding videography! These passions allow me to continue to learn and improve myself in addition to my professional career.

Thank you, Karen!

###

$40 Oil Will Return: This Isn’t the End of Fossil Fuels

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

Last week, May futures for WTI crude, a benchmark often used for U.S.-sourced oil, crashed into negative territory for the first time ever. It was the last day to trade a May contract, and with storage space filling up as oil demand craters, contract holders with nowhere to put the oil they were obligated to physically accept were forced to pay to have somebody take contracts off their hands. This moment represents a stunning new chapter in the ongoing oil crisis that has seen record drops for oil consumption and prices globally. Spot prices in May will remain depressed, and the June market is likely to be painful as well. It may seem like the days of $40 oil are behind us, and that we’re witnessing the beginning of the end for oil as the lifeblood of the global economy. We aren’t: Oil will one day return to $40 a barrel, but the last few weeks have demonstrated in hyperdrive how the oil endgame will play out.

It seems that oil isn’t the precious commodity it has been made out to be. Much ink has been spilled on the concept of peak oil, wherein dwindling reserves of oil cause rising prices as the marketplace becomes more and more supply-constrained. In the endgame scenario, supply shocks send prices soaring to levels that force global economies to find alternative fuels, renewable energy, or otherwise. A key issue with the peak oil theory is that ‘reserves’ are only counted if they’re known to exist and can be extracted with current technology.

As prices soared to upwards of $100 a barrel around 2008, many wondered if the high prices were here to stay, and if peak oil was coming to pass. Instead, high prices were just the motivation needed to unlock a bit of American ingenuity. Within 10 years, new technology unlocked vast fields of oil and gas throughout Texas, Pennsylvania, and the Dakotas. The ‘reserves’ in the United States multiplied, oil prices dropped, and the United States regained its status as the world’s leading producer of oil.

Peak oil, it turns out, is a story of peak demand. As some economies of the world begin to face the realities of climate change, new renewable and net-zero (or negative!) technologies have emerged and will emerge to supplant fossil oil. At first, these technologies require higher fossil prices, government programs, or both, to compete in the market. But as they mature and grow, prices come down. Demand for fossil will drop accordingly. And at some point, so little demand will exist for crude oil that producers will have to pay somebody to take if off their hands or stop producing it altogether.

This market conversion has already begun. Tesla has proven electric vehicles can out-perform and out-sexy the incumbents. Biorefineries are being built to turn household trash in to jet fuel. Governments are taking action to incentivize cleaner fuels. Nevertheless, action thus far has been spotty at best and despite the current market, peak oil demand has not yet come to pass.

The unprecedented demand destruction caused by COVID-19 will eventually subside as the threat of the pandemic wanes. The public will fly again, drive again, and buy plastic again; oil demand will ratchet up again. Shuttered wells won’t restart, stored oil will be drawn down, OPEC will maintain supply controls to balance government budgets, and prices will rise to $40 or more again. But someday, hopefully in the not too distant future, oil will again find itself in decline when a different (and more permanent) source of demand destruction weans the global economy off of fossil carbon for good.

###

Advanced Biofuels Cushioned Against Oil’s Crash

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

Oil prices are cratering to levels unimaginable just months ago and major ethanol producers are idling their plants. Although this is bad news for all types of fuels, renewable and fossil alike, there is a silver lining for advanced biofuels. These sources qualify for a broad set of renewable credits, diversifying their revenue streams and providing a layer of protection against the price destruction occurring in the fuels marketplace.

What’s an advanced biofuel? It’s a fuel produced using wastes or agricultural byproducts, such as the corn stalk instead of the kernel. (The kernel produces traditional ethanol, which directly competes with food-crops for land and farmer attention.) Potential feedstocks for advanced biofuel projects include household trash (known as ‘municipal solid waste’), leftover woody biomass material after logging operations (known as ‘slash’), and the shells from almond orchards.

These feedstocks are currently either landfilled, plowed under, or (depending on local regulations and the desire to follow them) burned. But in the United States, their use in biofuels production is incentivized through a variety of state and federal credit programs. The federal system, known as the Renewable Fuel Standard (RFS), primarily supports the entire domestic ethanol industry with ethanol-blend targets for the nation’s fuel supply. Less known is that the program also supports more advanced biofuels development. The RFS authors envisioned that corn-based ethanol would be a temporary bridge to an advanced biofuels future, and created multiple credits, known as Renewable Identification Numbers (RINs), to differentiate between the various feedstocks used to produce a biofuel. These RINs trade on open markets and their prices fluctuate based on the demand from ‘obligated parties’ (those required to buy RINs to demonstrate compliance with the statutory requirement).

One type of RIN is targeted at cellulosic fuels: the ‘D3’. This RIN has unique characteristics that make it more valuable that other RINs under the RFS. It is essentially a wild card: the RFS is a ‘nested’ compliance structure and the D3 RIN also counts as a ‘D5’ or ‘D6’. As a result, in times of oversupply, D3 prices are shielded from falling below the prices of these other RINs. Another unique feature of the D3 is the cellulosic waiver credit (CWC). The value of the CWC is set by the EPA annually, based on the price of gasoline in the Unites States. As gasoline prices fall, the value of the CWC goes up (albeit on a time-lag). In times of undersupply in the D3 market (not true at the moment), this built-in hedge means advanced biofuels projects are protected from oil price drops.

###

Getting the Kinks Out

The End of Partially Hydrogenated Oils

By Shawn Lee, Scientist

Right now, there’s a lot missing in grocery stores: toilet paper, bottled water, hand sanitizer, and… partially hydrogenated oils (PHOs). PHOs are popular with manufacturers of processed foods in need of a cheap butter alternative, or as preservatives to extend the shelf life of foods. However, since January 1, 2020, in the US you can no longer sell any foodstuff with PHOs as a major ingredient.

I became interested in food chemistry back in high school, where I investigated Kosher/Halal anti-foaming agents for maple syrup manufacturing in western Massachusetts. Niche as that was, I learned that, when dealing with commercial products, a technical analysis is always matched with an economic analysis, especially when an industry is seeking change. This realization led me to New Energy Risk, where I support the technoeconomic due diligence of our clients and pipeline. The types of analyses I did in the food industry were very similar to the energy technology analyses I work on at New Energy Risk.

Our clients need to stay abreast of industry regulations, which can immediately affect their feedstocks, off takers, and/or paths to commercialization. So it’s important for us to monitor old and new regulations, and to consider case studies that teach us how the businesses we work with might need to adapt, both commercially and technologically. Here’s one such example of policy change driving new technology implementation (or rather, old technology in new places); in this post, I’ll explain PHOs, how industry delayed their ban, and which replacement ingredients will be used going forward. It’s an interesting tale with lessons that spread beyond the breadbasket.

The Chemistry Behind Buttery Spreads

Partial hydrogenation is one of the most popular ways to control the freezing point of an oil, so it is spreadable like margarine: not too solid, but not too liquid either.

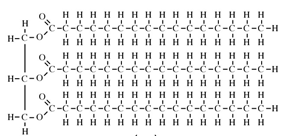

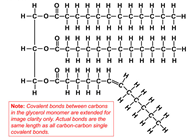

All oils, including vegetable oils, have three fatty acids linked to a glycerol, a simple compound that is colorless and odorless. These fatty acids are mostly long chains of carbon, which if fully saturated with hydrogen (i.e. lacking double bonds), can lay down flat on each other so that they are “unkinked.” This shape allows these fully hydrogenated fats to become solid at a lower temperature. Case in point, butter is fully hydrogenated, and at room temperature, butter is solid. But vegetable oil is not fully hydrogenated, so it appears “kinked,” and at room temperature, vegetable oil is liquid.

Butter: Solid, Unkinked http://www.indiana.edu/~oso/Fat/trans.html

Butter: Solid, Unkinked http://www.indiana.edu/~oso/Fat/trans.html

Vegetable Oil: Liquid, Kinked https://dlc.dcccd.edu/biology1-3/lipids

Vegetable Oil: Liquid, Kinked https://dlc.dcccd.edu/biology1-3/lipids

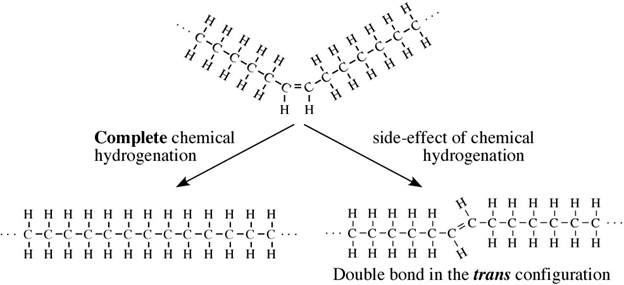

Most vegetable oils have kinks: double bonds that change the direction of the chain, keeping the oil molecules from stacking nicely and making them liquid at room temperature. To make them solid, you can add enough hydrogen to straighten out all those kinks, but that would result in a solid block of fat. Instead, food manufacturers add less hydrogen to do a partial hydrogenation, which straightens out only some of those kinks, resulting in a consistently spreadable product, or a PHO.

Unfortunately, in real life nothing is perfect, and in practice, chemical partial hydrogenation turns some of an oil’s double bonds from “cis” to “trans,” which are different molecular formations. You may have heard of trans fatty acids or “trans fats” before; these are PHOs with slightly crooked double bonds.

Double bond in the cis configuration:

Regulation and Industry

These trans fats have been correlated with increased LDL cholesterol, which has in turn been correlated with heart disease, the leading cause of death in the US according to the Center for Disease Control (in the times before COVID-19, anyway). Once these correlations were discovered, food regulations could mandate an end to the use of trans fats (and PHOs by extension) to avoid a further public health crisis. The US Food and Drug Administration (FDA) finally began taking action in 2015, concluding that PHOs were no longer Generally Recognized as Safe (GRAS).

But then on June 17, 2015, Industry complained about the regulations. Some claimed that PHOs are safe as minor constituents in coloring and flavoring additives, baking spray, and pie pan linings. The Grocery Manufacturers Association (GMA) cited two studies that relied on a model of animal metabolism… even though human data were available. It argued that trans-fat exposure against mortality risk should be modeled on an S-shaped curve as opposed to a linear curve, so that at low concentrations there would be almost no health effect. Unfortunately, these studies had poor-quality data at low exposure rates, and in some cases counted data twice. The FDA decided that the GMA finding — that PHOs are not necessarily bad for you at low levels — was unsupported. After failing to provide an environmental review, and given several other technical deficiencies, the FDA decided that PHOs as minor additives will still be banned and the petition was denied in its entirety.

However, the FDA did give the GMA an extension to figure out what could serve as a replacement for minor constituent PHOs. That extension expired on June 18, 2019, the last day it was legal to purposefully add PHOs into any foodstuff made in the US. Manufacturers and retailers then had six months to get products with PHOs as a major constituent through the supply chain, but by now, those products should mostly be gone from shelves. Since Jan 1, 2020, those products can no longer be sold, though minor additive- containing products may legally remain on the US shelves until 2021.

Alternative Technologies

Fortunately for food manufacturers, there are two primary alternatives that give us most of the benefits of partial hydrogenation without the health risks.

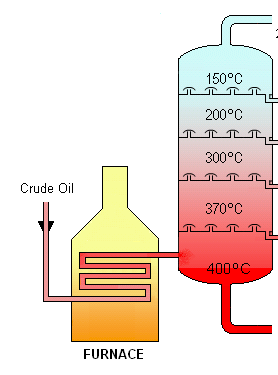

Fractional distillation: Natural oils are a mixture of different molecules with different melting points. You can separate these molecules by boiling off the mixture bit by bit (since the molecules will boil off at different temperatures, in a similar order to their freezing points).Then you can tailor your mix of oils and fats so in the aggregate they are a mix of solid and liquid around room temperature. Combine that mix with a small amount of surfactant to keep them from re-separating, and you’ll have a healthier replacement for PHOs.

Fractional distillation, so you can separate the oils by boiling point, https://en.wikipedia.org/wiki/Fractional_distillation

Fractional distillation, so you can separate the oils by boiling point, https://en.wikipedia.org/wiki/Fractional_distillation

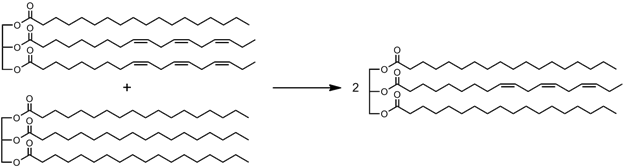

Interesterification: Alternatively, if the starting oil has lots of unsaturated fatty acids on one molecule, one can spread them more evenly amongst oil mixtures, so that fewer of the molecules are perfectly flat, and fewer are completely kinked. This will reduce the differences between the freezing points of the oil constituents, so they’ll be easier to keep from separating.

In renewable diesels, this same interesterification of vegetable oils with methyl acetate, a relatively small molecule, shrinks the average size of the molecules and decreases its viscosity, allowing it to be used in a conventional diesel engine.

Redistributing the double bonds (kinks) more evenly through the molecules, https://en.wikipedia.org/wiki/Interesterified_fat

Redistributing the double bonds (kinks) more evenly through the molecules, https://en.wikipedia.org/wiki/Interesterified_fat

Industry on Board

These regulations have been phased in over time; thus far we’ve seen no major hiccups in the removal of major constituent PHOs from the food supply chain, and this regulation has helped spur a number of new PHO substitutes without trans fats. These additives tend to be tailored to their use while reducing the LDL levels associated with conventional PHOs. In the long term, we could see a reduction in heart attacks and strokes in the US.

This is an example of regulation encouraging industry to adopt new technologies for the greater good. These are innovation opportunities for food chemical manufacturers, and the industrial agricultural companies that supply the ingredients they need. In the long term, as potential health results are realized across the population, we’ll also observe if/how buttery spread capital markets shift and consumer demands change. Which reminds us that regulation is one way to grease the wheels of invention.

###

Coronavirus Won’t Change Minds on Climate Change

In the absence of forceful government action, activists must stay on the front line.

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

As the global population is ravaged by the novel coronavirus sweeping across countries and continents, those searching for a silver lining have begun to suggest that the painful lessons of the current COVID-19 crisis may help change hearts and minds in the fight to curb climate change. The argument goes like this: If the parallels between the coronavirus crisis and the climate crisis can be properly explained to populations and their leaders, they will collectively see the need for action.

While I hate to add pessimism to an already trying time, I don’t count on that happening. The global response to the climate crisis, so woefully inadequate to address the scale of the problem, is not driven by a lack of understanding of the risks and realities of climate change. Even under the Trump administration, NASA’s climate change website touts the consensus of 97% of scientists that human-caused climate change is real. A full two-thirds of the American public believe the federal government is doing too little to combat the climate crisis. Leaders already know the threat we face, but largely fail to act anyways.

Instead, one enduring lesson of COVID-19 is how, in the face of near universal scientific opinion, political leaders routinely ignore expert advice and choose a path of maximum risk until significant damage has been done. Whether driven by advice from false authorities, fears of upsetting the status quo, or outright denial of the severity of the crisis, leaders around the world have repeatedly underplayed this crisis and failed to take definitive action to stem the onslaught. Even days ago, over 30 million people in the United States were free to congregate and actively continued the spread of the infection, even as deaths from the virus skyrocketed and hospitals in hard-hit areas set up tents to care for the patient surge. Faced with clear and imminent damage to communities and economies, some leaders still fail to act.

Others, however, do act: COVID-19 again demonstrated that action to stem a crisis can come from surprising sources. On the west coast of the United States, tech companies readily understood the science and implemented large-scale work-from-home policies a week or more before local governments followed (nevertheless as relative early adopters). As Washington D.C. argued about the severity of the crisis, the National Basketball Association, of all entities, showed true leadership by suspending its season, sparking a mass cancellation of high-density events from concerts to conferences.

This pattern is familiar to those on the front lines of the climate fight. In recent years, significant progress has been made in the private sector by focusing on so-called ESG (environmental, social, and governance) policies at major corporations. Major insurance providers and financiers now refuse to work with the coal industry, major private equity groups are backing off fossil fuel investments, and Microsoft is leading its industry by pledging significant carbon mitigation programs for its businesses. Progress is made in the absence of forceful government action.

With politicians now talking about further stimulus to recharge economies damaged by the COVID-19 pandemic, those fighting for the climate should stay in the fray and continue to work to secure programs and funding for a greener future. But absent an immediate, direct, relatable threat to our health and our economy, nobody should assume a sudden change-of-heart among the climate change deniers in Congress and the White House. On the climate front at least, it’s still business as usual: Politicians won’t be saving us; rather it’s our collective action that will bridge us to the future.

###

Troubles in the Fracking Industry Are Nothing to Celebrate

For those fighting climate change, the damage that American frackers are experiencing should be sobering.

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

With oil prices plunging from over $60/bbl to $30/bbl and lower in a matter of weeks, mid-sized American oil producers reliant on fracking have been identified as likely casualties from the sudden upheaval. The prospect of failures in the space is causing celebration among those opposed to fracking, with some trumpeting the end of an environmentally damaging process. The excitement is misguided: the failure of fracking companies in the current environment will portend increased difficulty stemming the climate crisis.

Hydraulic fracturing, or ‘fracking,’ is an oil and gas extraction technique that came in to heavy use in the United States around 2007. The process involves drilling long, horizontal wells deep underground in shale deposits, and then pumping high pressure water and chemicals to fracture the rock, increase permeability, and extract valuable hydrocarbons. Fracking was the key driver in pushing the U.S. to again become the largest oil producing country in the world over the last decade.

The technique has also been assailed as environmentally destructive. Poor control at some locations has been blamed for allowing drilling fluids to contaminate local water supplies. Earthquakes in Oklahoma dramatically increased after fracking became widespread. And leakage from fracking wells has been identified as a likely source of the increase in the atmosphere of the potent greenhouse gas methane since 2008.

But despite the environmental costs of fracking, the current situation is not one to celebrate. The underlying driver leading to pain at fracking companies is cheap fossil fuels, which will lead to more use of climate-driving fossil fuels and undermine efforts to decarbonize large swaths of the global economy. Saudi Arabia is now looking to pump over 12 million barrels of oil a day in April, an increase of 20% over January. Although global demand is currently constrained with the COVID-19 pandemic, cheap oil will surely lead to a rebound in demand and undercut competing alternatives, including biofuels and electric vehicles.

The situation is shedding light on a long-known truth in the energy world: prices are not driven by an efficient market based on supply and demand. Instead, the Saudis have longed dictated global prices, artificially limiting supply to hold a higher price. With a reported production cost of $2.80/bbl, the Saudis make considerable profit by constraining production. But as the last few weeks show, the Saudis also have the power to dramatically undercut competitors with little to no warning.

For those fighting climate change, the damage that American frackers are experiencing should be sobering: Saudi Arabia’s ability to suddenly flood the global market with cheap oil and undermine market-based efforts to supplant fossil fuels is an existential risk. If American frackers can’t compete with Saudi oil in an open market, greener alternatives surely won’t either.

###

Renewables Poised to Clean Up from Oil’s Price Spill

The oil market has changed dramatically in the last three weeks but renewables are financial safe bets

By Brentan Alexander, PhD; Chief Science Officer & Chief Commercial Officer

Saudi Arabia abruptly altered its oil production strategy in early March and began to flood the market with cheap oil. Financial markets worldwide hemorrhaged value at the prospect of a protracted and painful price war, and American oil firms immediately cut back spending and dividend payments as the price for their primary product halved. As of last week, WTI Crude (a pricing benchmark tied to US supply) was barely north of $20/bbl, prices not seen since 2002.

This sudden tumult represents an opportunity for the renewable energy sector. At first glance, this may sound counterintuitive. After all, oil prices seem largely unrelated to the prospects of wind, solar, and other renewables in the electricity generation sector, because in the United States the primary fossil source of electricity is natural gas. Natural gas prices have been largely uncorrelated with the price of oil since 2007, when large-scale domestic shale-gas production began to come online (see chart). In other parts of the world, coal drives electricity generation, which is similarly decoupled. Virtually nobody uses oil as a primary electricity source, except in certain very specific locations, such as Hawaii, where the demands of unique geography and supply logistics align to make oil the best bet for power production.

Data from US Energy Information Administration (EIA.gov)

Oil’s link to renewables instead comes through competition in the financing marketplace. As new projects are developed and financing is sought, the infrastructure funds that provide capital to enable these developments naturally prefer projects that promise the most attractive financial returns. With relatively high prices over the last decade and unmatched value as a transportation fuel, oil exploration has beaten out renewable project development on the financial metrics time after time.

The oil shocks over the last weeks could dramatically alter that calculus. Revenues for potential oil projects have suddenly dropped by over 50%, and futures contracts currently show only a modest improvement in prices by year’s end. The market is already pricing in the expectation that oil prices remain below $40/bbl for the foreseeable future, a dramatic change from the $55+/bbl that has been the norm for the last few years.

Even if prices do recover, the sudden volatility will still weigh on the minds of project investors. Oil markets haven’t resembled a purely competitive market since the mid 1960s, and since that time, prices have been regularly impacted by sudden and unforeseen changes in supply by OPEC producers, primarily Saudi Arabia. The rise in shale-oil in the US in the last decade has effectively put a cap on prices and provided a counterweight to OPEC’s pricing power. But the muscle being flexed now shows that the OPEC nations and Russia still maintain substantial influence over the fate of American oil producers. This ‘stroke of the pen’ risk, now that it has again bared its head, may be unlikely to be forgotten in the near future.

Renewables, by contrast, have no supply risk whatsoever, and are primarily exposed to fluctuations in the price of electricity. Insomuch as this relates to the price of natural gas, investors in the US will take comfort knowing gas is essentially a local market, with US prices driven by supply and demand within North America; there is little ability to arbitrage against global markets due to limited export capacity. Therefore, as oil prices come down, project financiers should start to turn more of their attention to the new safe bets that offer more durable returns: wind, solar, and the like.

This isn’t to say that renewables don’t face headwinds in the current environment. Cheap oil also competes with renewables in the transportation sector. Electric Vehicles will be less competitive with their gasoline-powered cousins as the price for gasoline at the pump drops, lowering demand for new grid capacity and forcing renewables to wait for retirements of current assets. The price for natural gas in the US is dropping as well, driven primarily by the sudden decrease in demand due to the shuttering of entire industries. These drops make fossil power from natural gas more competitive with their renewable counterparts.

Futures markets, however, are currently pricing in a full rebound of natural gas prices by year’s end, with the futures contract for Henry Hub for December 2020 currently priced above market levels at the end of 2019. This suggests that the drop in prices of natural gas will be temporary, and investors making long-term bets do not view the current situation as durable. Further, natural gas prices are just one component of the price paid by utilities to power producers, and so a drop in natural gas prices doesn’t necessarily imply a similar fall in the rates negotiated in new power purchase agreements. So the drop in natural gas prices evident in the market now looks to be temporary, and unlikely to dramatically alter the widespread conclusion that renewables are now the cheapest power source to build.

Altogether, the oil market has changed dramatically in the last weeks, in ways unforseen just a few short months ago. But despite the headlines and worrying drops across financial markets, opportunity lies in these disruptions. Renewables are well positioned to capitalize.

###