New Energy Risk Appoints George Schulz as Chief Executive Officer

New Energy Risk Appoints George Schulz as Chief Executive Officer

AVON, Conn.–(BUSINESS WIRE)–New Energy Risk (NER), a wholly owned subsidiary of Paragon Insurance Group and leading provider of customized technology performance insurance solutions for energy transition projects, today announced the promotion of George Schulz to Chief Executive Officer (CEO), effective June 1. Schulz succeeds outgoing CEO Tom Dickson, who is departing the company to explore new opportunities after more than ten years at the helm.

Schulz previously served as NER’s Managing Director of Program Development, a position in which he played a pivotal role in expanding NER’s underwriting capabilities and bringing innovative risk solutions to emerging sectors in renewable energy, sustainable fuels and infrastructure technology.

“George has a deep understanding of our business and a strong vision for where NER can go next,” said Paragon CEO Ron Ganiats. “With his background in financial services and as an innovator of technology performance insurance since its inception, George is uniquely suited to advance NER’s value proposition. He brings a combination of industry expertise and commercial insight, and we’re excited to see him lead NER through its next phase of growth.”

Ganiats also praised Dickson’s contributions: “We’re grateful for Tom’s decade of leadership. Under his guidance, NER helped unlock financing for some of the world’s most transformative projects. We wish him the very best in his next chapter.”

As CEO, Schulz will build on NER’s strong foundation and focus on broadening its risk solutions to enable impactful technologies in all phases of their lifecycle.

“I’m honored to take on this role,” said Schulz. “NER has a powerful mission, a unique position in the market and a world-class team that personifies its strong reputation. The team and I thank Tom for his leadership from the first policies to securing the ability to write multi-hundred million dollar risks. I look forward to leading the team and working with our valued capacity partners to proactively address the emerging risks and challenges of the energy transition.”

NER has a track record of delivering industry-leading technology coverage and is expanding its focus to adjacent sectors, including electricity markets, tax credit and feedstock supply.

New Energy Risk is a pioneer of large-scale, breakthrough technology performance insurance solutions. The company provides complex risk assessment and serves as a bridge between technology innovators, financiers, and insurers. Insurance policies are administered through New Energy Risk affiliate, Complex Risk and Insurance Associates, LLC, CA License #0I24307. Learn more: https://newenergyrisk.com.

Paragon Insurance Holdings, LLC, a Galway Holdings company formed in 2014, writes all commercial lines of insurance across more than 25 programs. Paragon’s industry-specific and general underwriting facilities offer insureds, retail agents, carriers, reinsurers and service providers unique product, service, capability and results. Learn more: www.paragoninsgroup.com.

New Energy Risk Supports Topsoe’s Electrolyzer Projects With Innovative Insurance Solution

New Energy Risk Supports Topsoe’s Electrolyzer Projects With Innovative Insurance Solution

MENLO PARK, Calif. — (BUSINESS WIRE) — New Energy Risk (“NER”), a wholly owned division of Paragon Insurance Group and leading provider of customized technology performance insurance solutions for energy transition projects, has entered into a partnership with Topsoe, a global leader in carbon emission reduction technologies. NER will serve as the preferred insurance supplier for Topsoe’s hydrogen electrolyzer business.

This partnership supports the global deployment of Topsoe’s hydrogen electrolyzer technology by facilitating cost-effective financing for the company’s customers. These customers can leverage NER’s technology performance insurance products to strengthen the bankability of their projects. This partnership follows NER’s completion of detailed technical due diligence on Topsoe’s hydrogen electrolyzer technology. Completing this process streamlines the underwriting and placement of performance insurance, and eligible projects will benefit from improved timelines and the potential for increased financing certainty.

Topsoe’s solid oxide electrolyzer technology expands on its extensive experience in electrolysis. These electrolyzers utilize Topsoe’s proprietary technology to convert water into sustainable hydrogen for a range of applications including transportation, manufacturing, energy storage and industrial processes.

“We recognize the potential of the hydrogen market to replace essential hydrocarbon feedstocks and are grateful that Topsoe, a company with over 80 years of excellence in the process industries, has entrusted NER to add value to its offering and support customer adoption,” said New Energy Risk’s CEO, Tom Dickson.

“Topsoe’s vast experience in chemical processing is evident in its solid oxide electrolyzer technology. NER has completed extensive technical due diligence and is proud to offer a world-class performance insurance product in support of this technology,” said Brad Price, Managing Director for Technical Due Diligence at New Energy Risk.

“Our partnership with NER is an important milestone to accelerate the delivery of our customers’ green hydrogen projects and is testimonial to the confidence in our technology. As the insurance provides performance coverage for commissioning, ramp-up and operations, it’s a strong de-risking tool supporting customers and investors with increased bankability for projects that involve our SOEC electrolyzers,” said Sundus Cordelia Ramli, CCO Power-to-X at Topsoe.

About New Energy Risk

New Energy Risk is a pioneer of large-scale, breakthrough technology performance insurance solutions. The company provides complex risk assessment and serves as a bridge between technology innovators, financiers, and insurers. Insurance policies are administered through New Energy Risk affiliate, Complex Risk and Insurance Associates, LLC, CA License #0I24307. Learn more: https://newenergyrisk.com/.

About Topsoe Energy

Topsoe is a leading global provider of technology and solutions for the energy transition. It combats climate change by helping its customers and partners achieve their decarbonization and emission reduction goals.

Based on decades of scientific research and innovation, Topsoe offers world-leading solutions for transforming renewable resources into fuels and chemicals for a sustainable world, and for efficient and low-carbon fuel production and clean air.

Topsoe was founded in 1940 and is headquartered in Denmark, with over 2,800 employees serving customers all around the globe. To learn more, visit www.topsoe.com.

About Paragon

Paragon Insurance Holdings, LLC, a Galway Holdings company formed in 2014, writes all commercial lines of insurance across more than 25 programs. Paragon’s industry-specific and general underwriting facilities offer insureds, retail agents, carriers, reinsurers and service providers unique product, service, capability, and results. Learn more: https://paragoninsgroup.com/.

Contacts

Media Contact:

Shawn Langlois

EVP Communications

Paragon Insurance Holdings, LLC

[email protected]

(310) 989-4895

Lexie Brazil

StreetCred PR

[email protected]

214-773-7114

A Healthy Check-In with F.O.A.K. Reality - A Whitepaper from IPA

By Krista Sutton

It’s no secret that we are big fans of Independent Project Analysis (IPA) here at New Energy Risk. Their whitepaper entitled “The Successful Management of New Technology Projects”, authored by Ed Merrow, is a good example of why. Bringing data driven insights to the murky world of project management is a noble and underappreciated contribution to the ecosystem. In this world littered with spectacular project failures and fraught with advertisements for the newest project management fad promising all manner of miracle, IPA stands apart by bringing real-world, data-backed insights to help project professionals and organizations better develop and execute projects.

In this whitepaper focused on new technology (our favorite subject!), IPA calls out some of the common issues we at NER observe projects hitting as they go through development and execution, and offers some best practices to make sure your project doesn’t get too far over its skis.

#1: Data Is Key

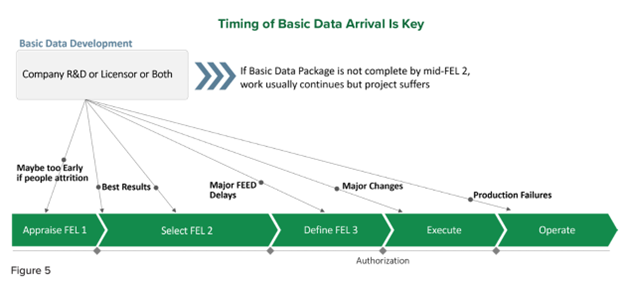

Too many times new technology companies will not have a fully developed basis of design, or it will be changed late in development or even (gasp!) during execution. Part of the basis of design documentation includes the heat and material balance summarizing the expected operating conditions and yields, and the definitions of feedstock & product composition and contaminants. Merrow refers to this as “Basic Data”. The basis of design is the heart of a project. The project has been set up to fail if there are any missing, unreliable or unrealistic data points, or if the Basic Data does not capture expected variability in the process, feedstocks, products or boundary conditions. While you and your team might execute the project flawlessly, if you have an incorrect or underspecified basis of design, you will still produce an asset with operability and reliability problems that underdelivers on project benefits. More often than not this either means investment to fix or, in the worst case, major write downs or even company bankruptcies.

As Merrow points out, project teams consistently overestimate how much Basic Data is available, especially in projects where the extent of technology novelty is not clear. He calls out “integration projects” where a commercially proven technology is being integrated into another commercial process and points out that such projects often underestimate the impact of that integration. IPA is even able to quantify this impact: 2.5% more unknowns in the heat and mass balance, 2.7% project cost growth, 0.5 months of additional startup time, and a 4.7% decrease in production after 7-12 months (based on nameplate design of 100%) [1]. It might sound acceptable but this effect is observed for EACH new integration, and BEFORE accounting for any new technology steps!

In response, it is recommended to pause development work and figure out a way to get the Basic Data required, i.e. through research, piloting, feedstock studies, cold flow studies, or field trials. The best practice that Merrow presents is to establish a “Basic Data Protocol” focusing on what is unknown (rather than a basis of design, which deals with what is known) and a process to obtain this data before heading into development work, to minimize repetition. Paul Szabo authored another relevant article on this topic, “Follow this Process Development Path “ [2], which discusses the benefits of completing a virtual commercial design, and then thoughtfully scaling that design down in a way that allows for all this data to be generated during piloting. The gaps in Basic Data need to be resolved before finalization of the design and the start of front-end engineering.

Merrow points out that a pitfall to be avoided, and one that NER has observed often, is a bias towards addressing data gaps with seemingly conservative design decisions such as extra spares or redundancy. This can give a false sense of security, whereas an empirical validation could have revealed potential causes of failure that exceed the conservative design assumptions or bypass them completely (e.g. unexpected contaminants). There is no guarantee that the right problem has been identified, all the consequences upstream and downstream have been accounted for, or how severe the problem might be at full scale. It can also make the project much more expensive without addressing the risk. It is the equivalent of wearing a helmet to ride a bike and finding yourself on a busy three-lane highway.

The first thing that NER looks for as part of due diligence is whether the project has performed the appropriate analysis, testing, piloting, and scoping to have a complete basis of design, and how that has been integrated into the engineering documentation. We have observed that where there is a lack of integrated pilot data, or sparse operational data, a project invariably ends up going back to do additional studies or repeat parts of the Front-End Engineering Design (FEED), or gets stuck in perpetual development, unable to move forward due to a lack of clearly defined project objective and data requirements.

Merrow provides a diagram in Figure 5 of his paper that nicely illustrates the effects of missing Basic Data.

#2: There is No Substitute for Development Work

Merrow has words of caution regarding the use of simulators and their applicability to predict the performance of different kinds of new processes. Simulators are useful for highlighting the important questions, but they are not a substitute for empirical process development work. When used properly, simulations can help narrow the range of experiments needed, and when calibrated against real world results, they can be beneficial in both the design and operation of a process. A common pitfall is trusting a model just because it seems precise and detailed, and not verifying the accuracy of modeling results against experimental lab and process data. Merrow points out an important observation: simulations are better at predicting the behavior of homogeneous materials, and are less capable if the process involves solids or heterogeneous mixtures. He concedes that examples do exist of process development leaping from bench scale to commercialization (citing up to 350,000X scale up!) with the aid of simulations, but these are the exception rather than the rule and success cases are confined to processes where the number of new steps are low and the process fluids are liquids and gases that are well studied with extensive property libraries. For most process development a pilot or a PDU (process development unit: a focused pilot where only the new steps are included) will be needed. Merrow offers these best practices for pilots and PDUs:

- All new process steps should be included.

- Any steps that have dynamic interaction with the new process steps should be included

- Any recycle streams and affected step should be included

- If the scale of the process step affects the behavior of the process (for example geometry, surface effects, flow regime, mixing etc) then you are likely to need to do a pilot at a larger scale. The essential principle here is to make sure that the equipment in the pilot or PDU adequately represents the larger-scale process.

To Merrow’s excellent points, I will add a fifth and sixth consideration based on NER’s experience.

- If you are innovating in an industry that expects meaningful sample sizes of on-spec product prior to executing an off-take contract (more common in solids processes or where your material will go into consumer products) or innovating in a nascent product market, you will need a fully integrated pilot, and it will need to be at the larger scale, which is typically referred to as a demonstration unit.

- If you have a heterogeneous feedstock that varies widely over time, then you will need a fully integrated pilot to understand variability effects on all the process steps, product quality, and yields.

In general, it rarely pays to skimp on piloting, and building a fully integrated pilot at the largest scale feasible will give the best outcomes in the commercial plant and avoid delays in the development process. In other words, do it right or be prepared to do it over.

#3: Solids are Hard (pun absolutely intended) - Plan Accordingly.

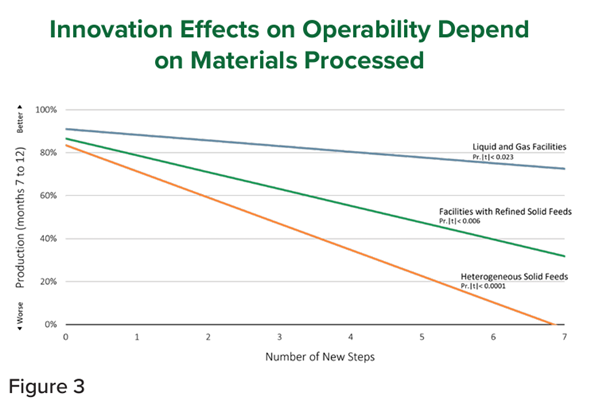

In the whitepaper Merrow, highlights the higher cost risk of new technology in the mining industry versus the chemical industry, and attributes this premium to the hard-to-model and often raw, unrefined, and heterogenous solid feedstock. In such industries Basic Data are expensive to develop and scaling is not always straightforward, so the scaling steps are naturally smaller leading to an increase in cost and time to develop, deploy, and scale innovative technology. Indeed, in Figure 3 from the whitepaper, shown below, Merrow paints the stark contrast between innovation outcomes in liquid and gas technologies versus technologies involving solids handling.

At NER, we have observed firsthand some common problems encountered during initial operations of new technology processes that involve solids handling, including modifications to solids handling process steps, the need for extra spare parts for solids steps, and even redesign due to solids carryover and plugging. The best practices here include limiting the amount of innovation you are introducing in a single project, performing integrated piloting including all solids handling steps, using equipment as close to the commercial scale and design as possible, and running pilots on real world feedstock with a wide range of realistic contaminants. In addition, it is important to recognize that even if you do all these things, you will still need additional contingency built into your start-up plan to cover inevitable solids handling issues when you are innovating in this space.

At NER we regularly see projects not planning for additional commissioning and start-up time in their financial models. This ultimately leads to unrealistic expectations from high-level stakeholders and a lack of funds to cover operating expenses or modifications when startup inevitably takes longer than advertised. This can lead to new technology companies needing to raise additional funds in the midst of commissioning just to continue operations.

Final Thoughts

In summary, this new technology focused paper from IPA gives us some very useful benchmarking tools for new technology projects and reminds us of the best practices and pitfalls associated with technology development and deployment. With the energy transition on an accelerated timeline and everyone hurrying to “deploy deploy deploy”, it is important to remember Professor Brent Flyvbjerg’s sage advice to projects from the highly quotable “How Big Things Get Done” [3]:

“Planning is relatively cheap and safe. Delivery is expensive and dangerous. Good planning boosts the odds of quick effective delivery, keeping the window of risk small and closing it as soon as possible”

Sources:

[1] Table 1, Merrow, E. W. & Independent Project Analysis, Inc. (2024, July). The Successful Management of New Technology Projects. https://www.ipaglobal.com/wp-content/uploads/2024/07/New-Technology-White-Paper.pdf

[2] Szabo, Paul. (2013). Follow this Process Development Path. Chemical Engineering Progress, December 2013, 24-27

[3] Flyvbjerg, Bent & Gardner, Dan. (2022). How Big Things Get Done: The Surprising Factors that Determine the Fate of Every Project from Home Renovations to Space Exploration, and Everything in Between. Penguin Random House 2023

The Case Against FOAK: Why you should stop calling your project a first-of-a-kind

By Ben Cader-Beutel

At New Energy Risk, we advise, evaluate, and insure projects being developed by climate tech innovators. And as the sector approaches a pivotal moment, with enhanced geothermal, third-generation biofuels and electrolytic hydrogen nearing project readiness, climate tech appears to be close to putting its awkward teenage years in the rear-view mirror.

There is a well weathered acronym that has taken on a new lease of life of late and is fast becoming lexicalized in innovation circles: “FOAK” (for “first-of-a-kind”). In vogue though it is, I believe the term is standing in its own way. Rather than fostering the deployment of novel technology into much needed infrastructure projects, FOAK has become the proverbial caution tape to project investors and lenders.

The Adoption of FOAK

We’ve seen a recent surge in sophisticated and well-funded climate hard-tech companies emerging from the low-interest rate COVID period. These firms are now transitioning from scrappy startups to fully-fledged developers, licensors, and equipment manufacturers (or a combination of all three). They are entering their deployment phase and encountering an underdeveloped ecosystem in comparison to their R&D and demonstration phases, which were supported by accelerators, a vast VC network, and government grant programs.

A key issue is the finance world’s inability to keep up with technology innovation, especially at the intersection of development and project finance. Early project returns do not match the significant capital outlay and perceived risk – at least in the eyes of conventional growth capital. And the industry has learned, through Clean Tech 1.0 that venture capital and SPACs are not good at building successful hardware companies alone.

“FOAK” is used by innovators and early-stage VCs to describe the project that takes the technology across the ‘valley of death’, through the ‘missing middle’. Much like catching the golden snitch, financing for such a project is unpredictable and elusive. While building the first commercial project is an important milestone in a hard tech startup’s journey and the beginning of sustainable returns for shareholders, it seems to me that the FOAK label has become more of a red flag to project investors than it is a signal for imminent growth.

FOAK’s Dilemma

I recently participated in an industry roundtable for a group of “FOAK EPCs”, “FOAK investors”, and “FOAK insurers”. The first agenda item was to define the term. Is it based on a bill of materials? The sponsor’s balance sheet? Feedstock source? As expected, everyone in the room had a different answer. This lack of consensus complicates the conversation; we can’t even agree on the pronunciation, for FOAK’s sake.

By my personal definition, a FOAK meets two criteria:

- The project includes any new technology or new integration of technology (even if the unit operations are all TRL-9 individually).

- The project generates enough cash to offer a positive return on investment.

But others in the ecosystem choose to include new geography, a new tax incentive, or a new offtake structure. Once you get broad enough, every project becomes a FOAK.

Reality is much more nuanced than any definition could capture. Projects are evaluated by investors and lenders individually and according to a robust set of criteria. Highlighting an aspect of project’s novelty limits its ability to attract such funding, even if it has proper mitigations in place for each of its risks.

FOAK is a large bucket, which tends to obfuscate important differences in technology and associated risk, calling out the ‘hair’ rather than the value. For example, flow batteries and cellulosic ethanol are fundamentally different projects, yet both are categorized similarly when seeking project capital. This alienates investors who may specialize in specific technologies or market segments and may in fact be able to understand the risk.

Beyond FOAK

Today’s terminology around project deployment calls out shiny novelty rather than value. The entire innovation ecosystem – startups, capital, and government – has a role to play in deploying new technologies, and the future of climate tech (and our planet) depends on making projects appeal to investors motivated by reliable returns.

So, what’s the solution? Shifting away from the FOAK terminology towards a more nuanced presentation of the spectrum of risk and respective mitigations could position projects to access broader pools of capital. With the proper tools in place, such as hybrid equity enabling investors to tap into future upside (see Twelve and Infinium’s recent raises), or project-centered risk mitigation tools such as NER’s performance insurance solutions, projects can abandon today’s unhelpful platitudes in favor of a carefully constructed scaleup strategy.

How Often Do Batteries Catch Fire?

By Shawn Lee

How often do batteries catch fire? There is a lot to this seemingly simple question. Battery systems can cost 100s of millions of dollars. Between 2017 and 2019, South Korea had 23 battery fires across multiple battery providers. LG Chem, one of the world’s premier battery manufacturers, lost $124M on its energy storage business in the first quarter of 2019 after seven consecutive quarters of profits. An Energy Ministry inquiry suspended five of the country’s 1,490 energy storage facilities during its audit, blaming poor installation quality, incomplete electrical shock protection, and a lack of overall controls for integrated systems. [1]

Lithium-ion batteries, the most common type, store energy by moving lithium ions between an anode comprising a high energy state material (generally some sort of neutral graphite) and a cathode comprising a low energy holding material (some kind of oxide). These two materials are kept electrically separated, which forces the electrons to flow in an outside circuit, where these electrons ultimately power anything from a lightbulb to a full electric car.

If for, whatever reason, the battery forms an internal electrical connection between the anode and the cathode, the battery will discharge all its energy through this short circuit in an uncontrolled fashion. This internal short circuit can be created by degradation due to the Battery Management System repeatedly discharging the battery too quickly or operating it out of its temperature range, or due to some sort of manufacturing fault. Either way, once the battery creates an internal short, it discharges a bunch of energy very quickly, and generates enough heat to boil liquid hydrocarbon electrolyte that separates the two materials (which incidentally is normally carcinogenic).

In most properly designed battery cells, the cell will vent the hydrocarbon vapor through pressure relief points. If the cell isn’t properly designed, the battery cell could burst in an unexpected way. In both cases, there’s now a hot hydrocarbon vapor mixing with atmospheric oxygen, which is perfectly capable of conflagrating and overheating the nearest intact battery cell and causing it to burn as well.

Very quickly, the effect can be a runaway fire burning from unit to unit. Developers can mitigate this by installing the batteries outdoors, using active fire suppression systems, separating clusters of battery units in space, and actively monitoring key parts of the battery and proactively taking parts offline and replacing them before they cause a fire.

When a battery fire happens, it’s a very high-profile event. The fire is typically very hot, can burn for longer than other kinds of fires, and the event can erode public support for new battery systems because they’re perceived as less well understood. Of course, no power technology is immune from fire.

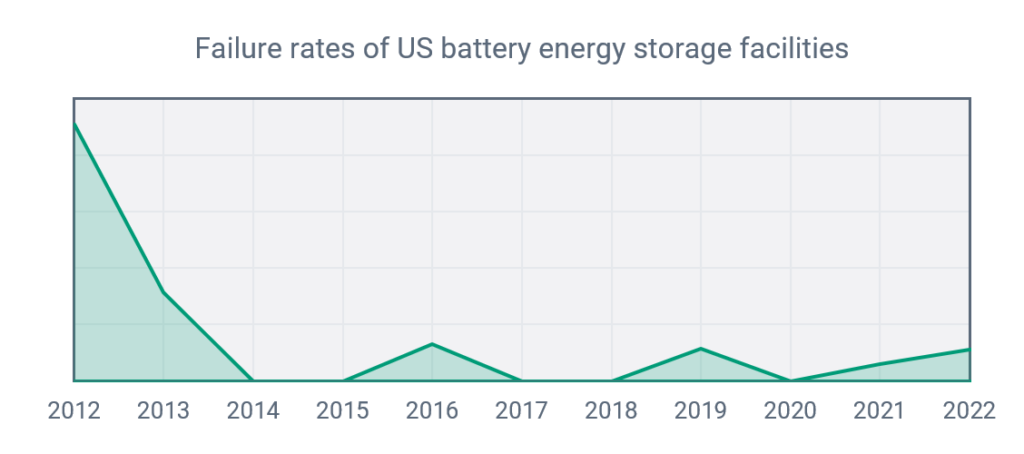

The good news, however, is that as an industry, we are no longer really in the wild west of battery fires. The frequency of large battery fires is easy to find, since they almost always make their way into the news. Fire data reported by the Electric Power Research Institute [2] combined with data on installed batteries in the United States from the Energy Information Administration, gives us a true sense of the yearly rate of failures. Large changes to the failure rate year on year are indicative of an immature industry still working out its kinks.

The battery industry reflected an immature industry before 2014. However, since then, US BESS failure rates have been relatively consistent, showing that even though we’ve yet to settle on a consensus on fire codes, internationally or within the United States, the battery industry overall has settled into a consistent fire rate. Of course, when they do happen, fires can be catastrophic and design practices play a part in limiting both the occurrence of fires, and their consequences.

At NER, we use an understanding of battery failure rates, and a technical understanding of individual root causes and mitigations, to support battery projects with warranty backstops and Battery Dispatch Insurance products which can supplement standard property covers and help batteries deploy at scale.

Sources:

[1] https://www.spglobal.com/marketintelligence/en/news-insights/trending/bVy2KGU3Opsle5Vv8QG0-Q2

[2] https://www.pv-magazine-australia.com/2021/09/28/australias-biggest-battery-cleared-for-testing-following-fire-fallout/

New Energy Risk, Westfield Syndicate Launch New Lloyd’s Lineslip

New Energy Risk and Westfield Syndicate Have Launched a New Lloyd's Lineslip

AVON, Conn.--(BUSINESS WIRE)-- Specialist managing general underwriter in the global energy transition, New Energy Risk (NER), and leading insurer Westfield Syndicate have announced the launch of a new Lloyd’s lineslip focused on providing technology performance insurance and other innovative insurance products to the energy transition space. With the additional capacity available under the lineslip, NER continues to expand its platform to accelerate innovation in the energy transition space. NER’s insurance solutions enable its clients to advance the breakthrough technologies required to meet the world’s climate and sustainability targets. The capacity will be available, alongside NER’s existing capacity arrangements, to service demand arising in areas such as fuel cells, hydrogen, low-carbon fuels, carbon capture and U.S. tax credits. Guy Carpenter served as the sole placing broker and were responsible for securing the required capacity.

“With the passage of the Inflation Reduction Act in the U.S. and similarly ambitious support in the U.K., Europe and elsewhere, the energy transition is at an inflection point. Since 2013, NER has enabled over $4B of capital deployments and almost a quarter of that has been in the past 12 months. NER is proud to be operating with Lloyd’s and its history of innovation building the partnerships necessary to continue supporting this trend and bringing impactful technology to the market at scale.” said Tom Dickson, CEO of New Energy Risk.

“New Energy Risk are bridging the gap between insurance and the deployment of breakthrough technologies in renewable energy and at Westfield Specialty we are delighted to be able to support this. Tom and his team have a sophisticated approach to the challenges presented by new technologies and we are excited by the prospects of being a part of the transition journey alongside New Energy Risk.” Jeremy Shallow, Deputy Active Underwriter, Westfield Specialty Syndicate 1200

Rachel Turk, Chief Underwriting Officer, Lloyd’s said: “Insurance has a vital role to play in creating the environment in which new lower carbon technologies can reach scale and commercial viability and we are very supportive of thoughtful and disciplined underwriting that supports the goals of the global energy transition. We are delighted to see the allocation of risk capital to businesses focusing on the transition to renewable energy and with the recent launch of the TCX transition risk code, this will enable the market to further lean into the opportunities that transitioning to a lower carbon economy brings.”

“This new lineslip will enable New Energy Risk to provide insurance solutions to clients which encourages additional capital to develop renewable clean energy technologies. The Lloyd’s market is an efficient way for NER to use the lineslip to service growing insurance demand. Guy Carpenter is committed to helping clients source capacity for innovative solutions in a new era of risk.” Henry Sanderson, Head of Innovation & Emerging Risks, Global Specialties, Guy Carpenter.

About New Energy Risk

New Energy Risk is a leading provider of innovative technical risk transfer solutions to the sustainable industry worldwide and pioneered the development of large-scale technology performance insurance. It was founded in 2010 to provide complex risk assessment and serve as an effective bridge between clean-energy innovators and insurers enabling the commercialization of novel technologies and businesses driving the energy transition. Since then, New Energy Risk has helped its customers gain over $4 billion in financing and sales for renewable energy and new technology deployments. To learn more, please visit www.newenergyrisk.com

About Guy Carpenter

Guy Carpenter & Company, LLC is a leading global risk and reinsurance specialist with 3,500 professionals in over 60 offices around the world. Guy Carpenter delivers a powerful combination of broking expertise, trusted strategic advisory services and industry-leading analytics to help clients adapt to emerging opportunities and achieve profitable growth. Guy Carpenter is a business of Marsh McLennan (NYSE: MMC), the world’s leading professional services firm in the areas of risk, strategy and people. The company’s more than 85,000 colleagues advise clients in over 130 countries. With annual revenue of $23 billion, Marsh McLennan helps clients navigate an increasingly dynamic and complex environment through four market-leading businesses including Marsh, Mercer and Oliver Wyman. For more information, visit www.guycarp.com and follow us on LinkedIn and X.

Contacts

Media

Gregory FCA for New Energy Risk

Kara Lester

[email protected]

NER 2023 Sustainability Report

Sustainability is at New Energy Risk's core, highlighted in detail in our 2023 NER Sustainability Report. Our business model delivers performance insurance solutions to a wide range of energy technologies and related infrastructure projects and technologies that have a major impact on our world, from reducing emissions to creating more sustainable fuels, to finding new uses for municipal and industrial wastes, to new models for low-carbon transportation. We help drive these technologies to scale and foster greater customer adoption to accelerate a more sustainable society.

Read NER's latest sustainability report from our CEO, Tom Dickson, Chief Actuary and Managing Director of Underwriting Development, Sherry Huang, Senior Scientist, Shawn Lee and Manager of Business Development, Richard Riley. The report details the results of the sustainability efforts of NER’s client portfolio, where innovations to reduce carbon intensity for fuels and power, as well as to promote the circular economy and curb waste, have delivered measurable results amid the energy transition.

Interview: Sue Coates, Trident Public Risk Solutions

Interview: Sue Coates, Trident Public Risk Solutions

We are inspired by people who are passionate about insurance, project finance, and technology that solves pressing global challenges. In this interview series, our chief actuary, Sherry Huang, talks with friends of New Energy Risk whose work makes a difference, and whose journeys will inspire you, too.

Sue Coates serves as the President of Trident Public Risk Solutions, member of Paragon Insurance Holdings. During Paragon’s recent ‘Sleep-Out’ event to raise money for homeless shelters for teens, Sue led and joined a large team and supported the cause by example. Ever since New Energy Risk joined the Paragon group, I heard great things about Sue and her leadership. I had the privilege of speaking to her recently to find out about how she got to where she is today, what she thinks of effective leadership, and what she is looking forward to in 2024.

Sue Coates serves as the President of Trident Public Risk Solutions, member of Paragon Insurance Holdings. During Paragon’s recent ‘Sleep-Out’ event to raise money for homeless shelters for teens, Sue led and joined a large team and supported the cause by example. Ever since New Energy Risk joined the Paragon group, I heard great things about Sue and her leadership. I had the privilege of speaking to her recently to find out about how she got to where she is today, what she thinks of effective leadership, and what she is looking forward to in 2024.

This interview has been lightly edited for length and clarity.

Please tell us a little about how you got to where you are today.

I started my career with a humble beginning as a representative at an independent insurance agency in personal lines. I quickly found I had a knack for understanding insurance contracts and was good at providing customer service. After a few years, a former colleague of mine recruited me to an MGA with a specialization in public entity insurance solutions, which is how I started in this space. This MGA was later acquired by Trident Public Risk Solutions. Over the last 16 years, I worked my way up from an underwriter to a manager, to an underwriting director, and eventually the President. Trident was acquired by Paragon in 2020 and we are now part of the Paragon MGA platform.

What are some unique aspects of providing insurance solutions for public entities?

Public entity is a great class of business that requires highly specialized knowledge to serve. Trident offers a wide range of insurance solutions to municipalities, public water/wastewater treatment utilities, counties, and public schools. As funding for insurance premiums is supported by taxpayers, our accountability standard is steep. We strive to help agents and policyholders manage through an evolving insurance landscape and make sure they have access to appropriate insurance solutions. Many of us at Trident have developed a personal connection and a deep appreciation for public servants. We are committed to the long-term stability of the program.

What is your leadership style?

I am a people-first leader, or you can say a servant leader. My goal is to become a resource at every level for all stakeholders in our business. As a leader, my job is to clear barriers and allow people to expand their intellectual curiosity and fulfill their career aspirations. In my own career, the first transitions to management and leadership were both hard – I had to let go of being the first point of contact and make sure to leave space for people to grow and develop. My clock/horizon is different from my team – I need to look ahead in the future and be attentive to the ‘WHY’ and ‘HOW’ in everything we do. I make sure my leadership team has complementary skills, so we can benefit from different ways of looking at the business.

Would you tell us about your sleep-out experience with Covenant House supported by Paragon?

I am thankful that Paragon sponsored this event for Covenant House, which is an organization that provides support and shelter for youth homelessness. I am grateful that I was able to share this sleep-out with my colleagues and it is definitely a unique and powerful team-building experience. Some of the personal sharing from people who benefited from Covenant House’s support was very moving, and reminded us all to stay humble of what we have and pay it forward.

What are your goals for the company in 2024?

Create more value for our customers, grow the team to continue to enhance our capabilities and provide high quality solutions.

New Energy Risk and Ascend Analytics Support Leading Renewable Energy Infrastructure Fund

New Energy Risk and Ascend Analytics Support Leading Renewable Energy Infrastructure Fund on Merchant Battery Projects in ERCOT with Custom Revenue Insurance Solution

AVON, Conn.--(BUSINESS WIRE)--New Energy Risk (“NER”) and Ascend Analytics, LLC (“Ascend”) have announced the closing of an industry-first energy storage insurance policy providing coverage for the performance of Ascend’s battery storage forecasting and bidding optimization platform. The policy will enable the financing of a portfolio of grid-scale energy storage facilities in Texas’s ERCOT power market. NER is a leading insurance agency specializing in insurance solutions for technology in the energy transition that act as an effective bridge between technology innovators, their customers and lenders, and the insurance markets. Ascend is a leader in energy market valuation and dispatch optimization, whose independent economic assessments have supported over 100 project financings and whose SmartBidder™ platform conducts live dispatch operations across six ISO’s in the United States.

The policy ensures the performance of Ascend’s forecasting and SmartBidder™ technology stack to provide a revenue floor to the project over a multi-year term. Unlike alternative revenue risk transfer solutions, the offering both secures minimum revenues and permits the projects access to upside revenue from lucrative, high-volatility events that are regularly experienced in ERCOT.

Bringing to the market new energy storage capacity is a necessary element of the energy transition, adding flexibility and resilience to the grid to permit the interconnection of more renewable capacity.

“Ascend's storage valuation has supported a majority of batteries operating in competitive power markets. In addition to SmartBidder's proven bid optimization capability, Ascend leads the market in their ability to provide the analytics required to assess and actively manage energy storage market risk,” stated Tom Dickson, CEO at NER. “NER has been able to apply its modeling expertise of highly technical risks to Ascend’s robust framework to implement a precise transfer of risk.” continued Dickson.

“This offering with NER helps developers confidently deploy capital to support merchant storage operations by providing a revenue floor while preserving the upside potential of ERCOT’s more extreme events. The innovative downside risk coverage enabled the storage developer to earn minimum returns, facilitating asset financing and furthering the transition to reliable clean energy in Texas,” stated Gary Dorris, CEO of Ascend Analytics.

About New Energy Risk

New Energy Risk is a provider of innovative technical risk transfer solutions to sustainable industry worldwide and pioneered the development of large-scale technology performance insurance. It was founded in 2010 to provide complex risk assessment and serve as an effective bridge between clean-energy innovators and insurers enabling the commercialization of novel technologies and business cases. Since then, New Energy Risk has helped its customers gain over $3 billion in financing and sales for renewable energy and new technology deployments. To learn more, please visit www.newenergyrisk.com.

About Ascend Analytics

Ascend Analytics, an innovative leader at the forefront of the energy transition, offers advanced software and consulting services that capture the evolving and real-time dynamics of energy markets. The company provides its customers with optimized and comprehensive decision analysis that covers everything from long-term planning to real-time operations in the electric power supply industry. For more information on Ascend, please visit www.ascendanalytics.com.

Contacts

Media

Gregory FCA for New Energy Risk

Kara Lester

[email protected]

Ascend

Leela Gill

[email protected]

The US Treasury Releases Guidance on SAF Emissions Rates, but How Many Questions Does it Answer?

By Krista Sutton – Principal Process Engineer

Last week, the Treasury released their long-anticipated guidance [1] on emissions rate calculations for the 40B sustainable aviation fuel (SAF) tax credit established by the Inflation Reduction Act (IRA), which is likely to serve as a model for the 45Z clean fuel tax credits with regards to SAF (although such guidance has not been issued, or equivalency explicitly indicated). Let’s dive in…

What is at stake?

Under Section 40B, the IRA established a tax credit value of $1.25 per gallon of SAF, meaning aviation fuel with an emissions rate at least 50% lower than fossil jet fuel. The act includes an adder of 1¢ per additional percentage-point reduction beyond 50%, up to a maximum of $1.75 per gallon. Section 40B makes tax credits available through the end of 2024.

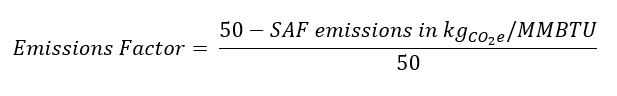

Under Section 45Z, also newly created by the IRA and which makes tax credit available from 2025 through 2027, credit value is calculated as an emissions factor multiplied by an applicable amount, which for SAF is $1.75 per gallon. The emissions factor is calculated as follows, meaning that tax credit value accrues from a baseline emissions rate of 50 kgCO2e per MMBTU.

The SAF emissions are calculated through a lifecycle analysis (LCA) methodology – a topic of much debate. At the heart of the issue is whether corn-based ethanol-to-jet production and soybean oil-to-jet production will qualify for the tax credit. The guidance around LCA methodology will ultimately determine how competitive 13.8 billion gallons a year of US ethanol production [2] would be with respect to other feedstocks for the production of SAF.

Why is there an argument?

A debate has been raging since the passage of the IRA over which lifecycle analysis modeling methodologies should be accepted to estimate SAF emissions. Sections 40B and 45Z specifically call out the International Civil Aviation Organization (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) methodology:

“the most recent Carbon Offsetting and Reduction Scheme for International Aviation which has been adopted by the International Civil Aviation Organization with the agreement of the United States, or…”

but leaves room for debate in the following paragraph:

“any similar methodology which satisfies the criteria under section 211(o)(1)(H) of the Clean Air Act (42 U.S.C. 7545(o)(1)(H)), as in effect on the date of enactment of this section.”

On one side of the debate, the biofuels industry and airlines have argued for the inclusion of the ANL-GREET (Argonne National Labs (ANL) Greenhouse Gas, Regulated Emissions, and Energy Use in Transportation) model which is used as the basis for lifecycle analysis for all the other low carbon fuels eligible for the 45Z tax credits. These stakeholders cite its more frequent update cycle and more recent datasets containing the most up-to-date advances in the industry. [3]

On the other side, environmental groups have argued that the GREET model is not as stringent in accounting for emissions resulting from indirect land use change (ILUC) as the ICAO CORSIA methodology, and that the use of the ANL-GREET model would grossly undercount emissions from a land use transition to grow crops for SAF production. [4]

What is the difference between the models?

Estimates for direct emissions from these models are actually quite similar, as a version of GREET was used to derive the default LCA factors by the ICAO. However, there are key differences related to the modeling of input assumptions for indirect emissions between the ANL-GREET and ICAO CORSIA methods; specifically:

- How the two models develop the ILUC factors;

- The allowed land-use basis;

- The data referenced for each type of land use conversion; and,

- Whether they give credit for sustainable farming practices via soil organic carbon (SOC) modeling.

These assumptions can make a large difference in the final emissions numbers according to the International Council of Clean Transportation:

“ILUC modeling cited in some configurations of the default GREET model estimates land-use emissions for corn ethanol and soy that are only 25% – 33% of the total emissions estimated through public regulatory assessments by the U.S. Environmental Protection Agency and the California Air Resources Board” [5]

So, what did the guidance say?

A likely less contentious part of the guidance establishes a safe harbor for fuels that qualify for D4, D5, D3, or D7 Renewable Identification Numbers (RINs) under the incumbent renewable fuels standard (RFS) administered by the EPA. Fuels meeting D4 or D5 certification will be automatically considered to have a 50% emissions reduction and fuels meeting D3 or D7 certification will be considered to have a 60% emission reduction for the purposes of 40B credits.

On the modeling side, the guidance, at least on the surface, has handed a win to the airlines and biofuels industries, and particularly ethanol producers that are transitioning to SAF production, by authorizing a GREET-based model as an acceptable alternative for determining the life cycle GHG emissions of SAF. In reality, they have kicked the can down the road as the guidance references a new GREET model being developed to meet the criteria of 40B that is planned to be released on March 1st, 2024. The updated model could incorporate more stringent indirect land-use change factors. This would effectively authorize the use of the GREET model (what the industry wants) and implement stricter ILUC factors (what environmental groups want). For now, it leaves the door open for a wider pool of crop-based SAF to qualify for 40B credits so we can be sure that the debate will continue, and we will see which way the pendulum swings on March 1st, 2024.

Sources:

[1] https://home.treasury.gov/news/press-releases/jy1998

[4] https://theicct.org/wp-content/uploads/2023/09/ID-16-Briefing-letter-v3.pdf

[5] https://theicct.org/long-shadow-model-inputs-could-dilute-ambition-of-saf-grand-challenge-nov23/